When it comes to Health Savings Accounts (HSAs), there’s no shortage of information and advice out there. However, many articles tend to focus on the theoretical benefits of HSAs without providing concrete examples.

In this post, we’ll follow the journeys of two Sarah’s. One of them plays by the rules (and knows the rules perfectly). The other Sarah… is just living her life.

Perfect Sarah

Perfect Sarah does everything correctly and wants to take full advantage of her HSA contributions.

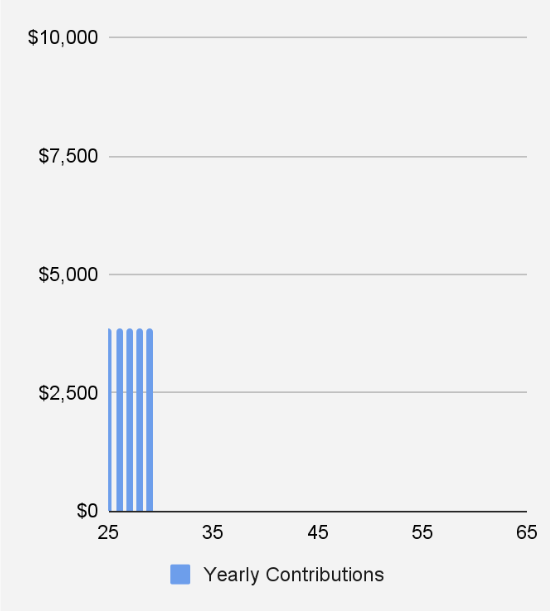

Early Years (Ages 25-29)

Age 25: Perfect Sarah starts a new job and enrolls in a new health insurance plan. Her new health insurance allows for an HSA, and Perfect Sarah had heard she could use it to save some money on her taxes.

She eagerly contributes the maximum amount allowed each year ($3,850 per year).

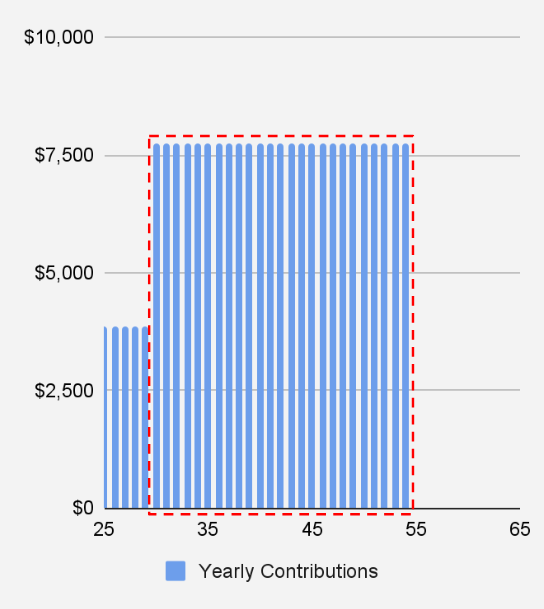

Marriage & Family Planning (Ages 30-54)

Age 30: Perfect Sarah gets married to a boy with no health insurance. She adds him to her health insurance plan, which means she can now contribute more to her HSA. She contributes the maximum each year ($7,750 per year).

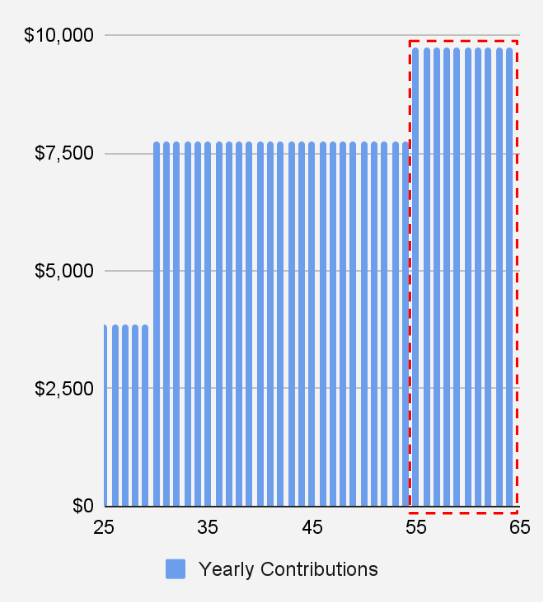

Catch-up Contributions & Retirement (Age 55+)

Age 55: Perfect Sarah is really excited about turning 55 because she knows this is the age when she can contribute even more into her HSA (an additional $1,000 per year per spouse).

Age 65: Perfect Sarah and her husband retire. Sarah is sad because she can’t contribute to her HSA anymore.

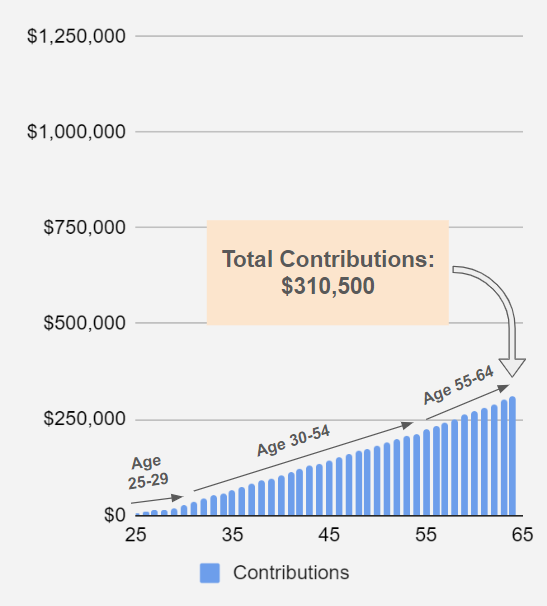

How Did Perfect Sarah Do?

Let’s take a closer look at how Perfect Sarah did, considering her diligent method of contributing the maximum every year.

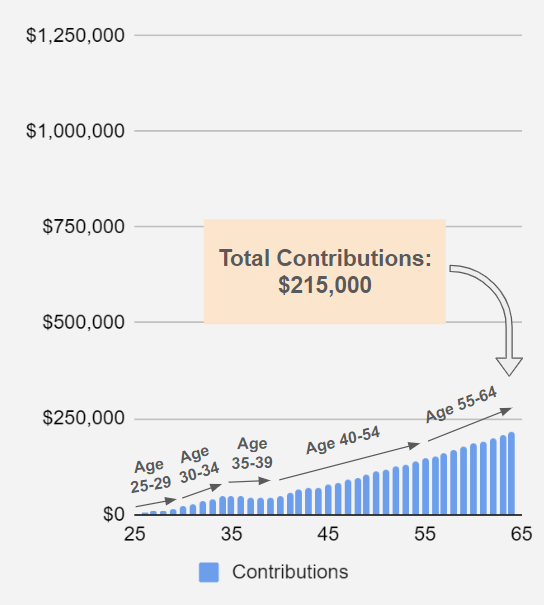

Total Contributions:

- Ages 25-29: $3,850 x 5 years = $19,250

- Ages 30-54: $7,750 x 25 years = $193,750

- Ages 55-64: $9,750 x 10 years = $97,500

Adding up all the contributions gets us to $310,500 total contributions over Sarah’s lifetime.

Investment Growth:

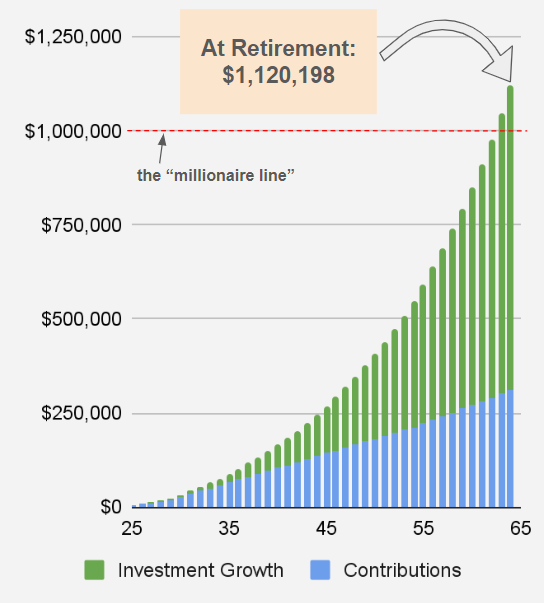

Perfect Sarah invested all of her contributions each year and never took any money out.

So Perfect Sarah’s money grew 6% per year with the stock market…

… over 40 years.

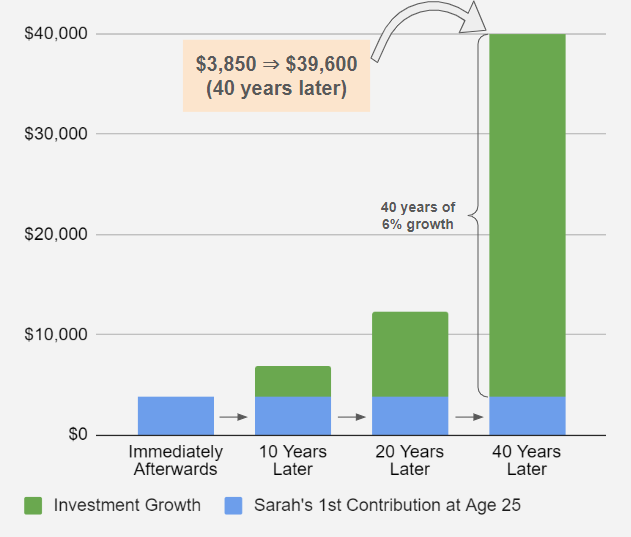

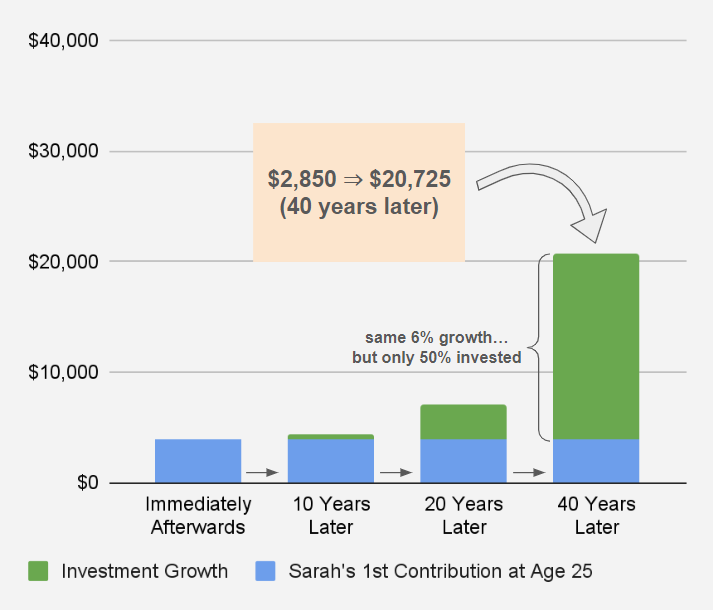

And so if we take a look at her first ever HSA contribution of $3,850, for example…

… it now looks ~10x bigger.

Behold, the power of compound interest!

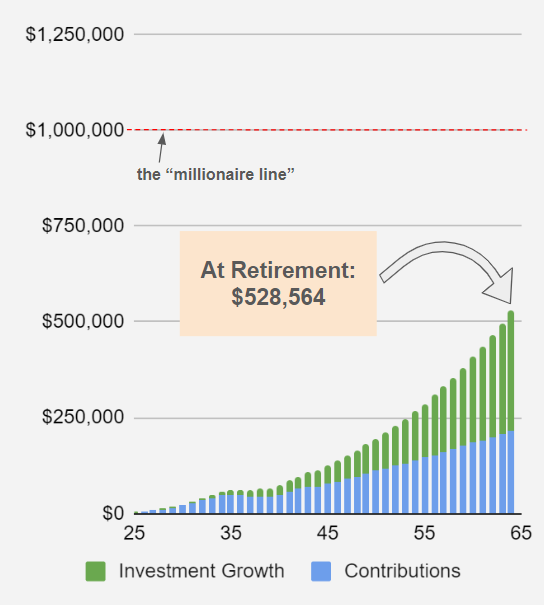

Total HSA Balance at Retirement:

After adding up Sarah’s contributions and investment growth, Perfect Sarah has over $1 million in her HSA account.

Perfect Sarah could have used her HSA for medical expenses along the way, but she chose to wait and invest it. Because of this, $310,500 worth of contributions generated $809,698 of investment growth! Perfect Sarah is now a millionaire, but only saved less than a third of that amount.

How Sarah Can Use Her HSA In Retirement:

Perfect Sarah can use her million dollars to pay for medical expenses tax-free, which certainly gives her a lot of money to play with. Medical costs can quickly add up, especially in retirement. HSA money can even be used to pay for monthly Medicare premiums, which Sarah is now eligible for at age 65. On top of that, medical and long-term care needs are likely high at this age, providing ample opportunity for Sarah to use her HSA funds.

But suppose Sarah wants to dip into her HSA freely.

Sarah can actually use HSA money for both medical and non-medical expenses, as long as she pays income taxes on the money used for non-medical expenses. In fact, starting at 65 years old, Sarah can use her HSA exactly like a regular pre-tax retirement account.

Using HSA money for non-medical expenses isn’t as savvy, since withdrawals aren’t tax-free. However, the income taxes Sarah needs to pay on these withdrawals probably aren’t very high anyways, since she is retired. Using HSA money for non-medical expenses is a special perk that HSA accounts have for people aged 65+. Because of this, Sarah never has to worry about whether she can use up all her HSA money.

The Trials and Tribulations of Real Life Sarah

Real Life Sarah isn’t Perfect Sarah in that she has real-life things happen to her. Let’s see what kinds of things happened in her life and how she navigated them.

Early Years (Ages 25-29)

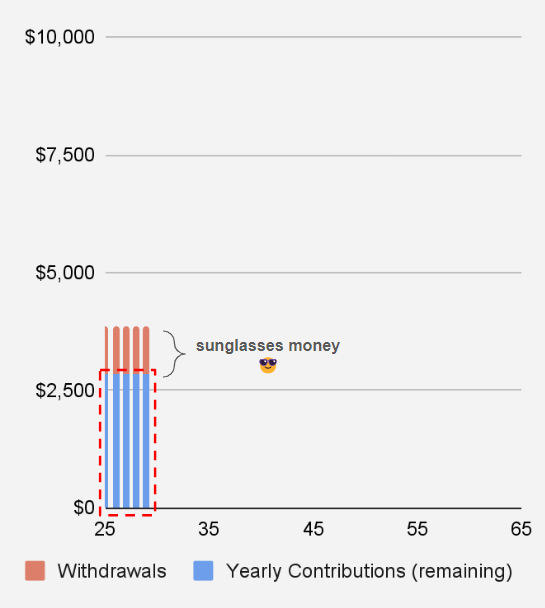

Age 25: Real Life Sarah starts a new job and her new health insurance also allows for an HSA.

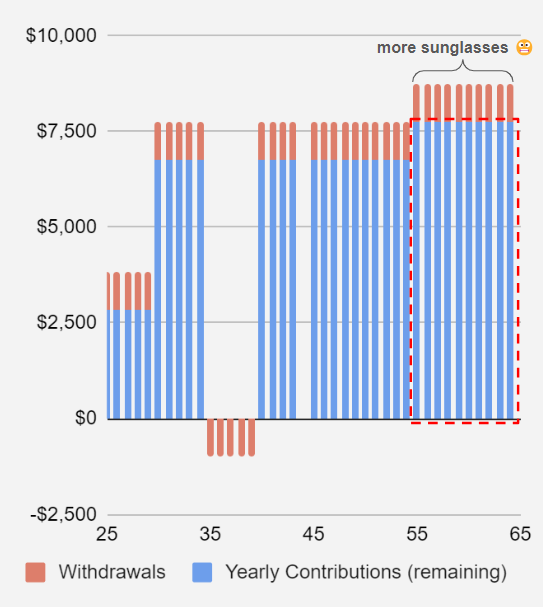

She contributes the maximum amount allowed every year, but also decides to treat herself by taking out $1,000 every year… to spend on multiple pairs of fancy prescription sunglasses.

Marriage… And Other Things (Ages 30-54)

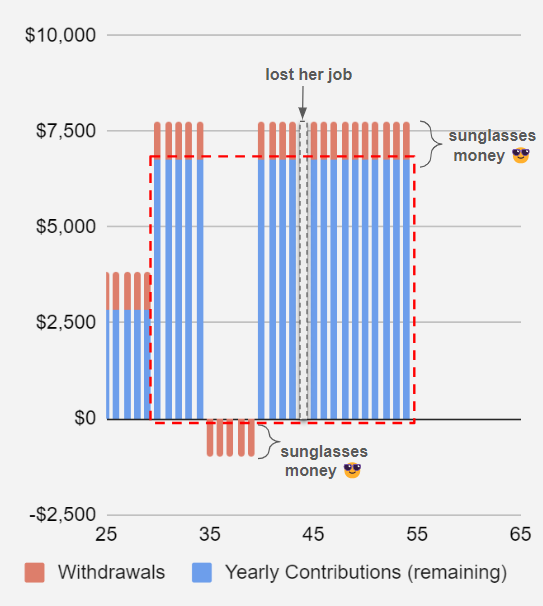

Age 30: Real Life Sarah also gets married and adds her husband to her health insurance plan. She decides to contribute more to her HSA, but continues her yearly $1,000 sunglasses habit.

Age 35: Real Life Sarah changes health insurance when her kids kept having to go to the doctor. Her new health insurance does not allow for an HSA.

However, she could still use her existing HSA funds on prescription sunglasses during this time, even though she couldn’t contribute any new money.

Age 40: Real Life Sarah’s kids are older now and don’t have to go to the doctor as much. She switches back to a health insurance plan that lets her have an HSA.

Age 44: Real Life Sarah loses her job. However, this also means she lost her health insurance through her job. She decided she didn’t have to buy new sunglasses this year.

Age 45: New job! And best of all, the new job came with health insurance that let Sarah contribute to an HSA again.

Real Life Sarah vows to contribute the maximum amount to her HSA to make up for lost time, while re-embracing her sunglasses habit.

Catch-up Contributions & Retirement (Age 55+)

Age 55: Real Life Sarah really doesn’t want to increase her contributions, but her husband does. They compromise and only contribute an extra $1,000 for both of them (instead of the allowed $2,000 extra). But Sarah didn’t forget about her yearly sunglasses!

Age 65: Real Life Sarah and her husband retire, and Sarah is ready to enjoy the rest of her HSA money.

How Did Real Life Sarah Do?

Let’s take a look at how Real Life Sarah did versus Perfect Sarah.

Contributions Breakdown:

- Ages 25-29: ($3,850 – $1,000) x 5 years = $14,250

- Ages 30-34: ($7,750 – $1,000) x 5 years = $33,750

- Ages 35-39: ($0 – $1,000) x 5 years = -$5,000

- Ages 40-54: ($7,750 – $1,000) x 14 years = $94,500

- Ages 55-64: ($8,750 – $1,000) x 10 years = $77,500

Real Life Sarah only contributed $215,000 versus Perfect Sarah’s $310,500.

Investment Growth:

Real Life Sarah decided to invest 50% of her HSA, and her money grew grew 6% per year, same as Perfect Sarah’s. After taking out $1,000 (for sunglasses), Sarah’s first HSA contribution comes out to $2,850 with $1,925 of it invested in the market.

If we look at Sarah’s first HSA contribution after 40 years, she ends up with $20,725.

A pretty good result…

… but not when you consider that Perfect Sarah ends up with $39,600, roughly doubling Real Life Sarah’s amount.

Real Life Sarah lost out on almost $20,000, even though both made the same initial $3,850 contribution. The effects of compounded 6% growth on the uninvested half of Sarah’s contribution had a dramatic effect after 40 years.

Total HSA Balance at Retirement:

After adding up Sarah’s contributions and investment earnings of $809,698, Real Life Sarah at age 65 has $528,564 in her HSA account (and 39 pairs of sunglasses).

Unlike Perfect Sarah, Real Life Sarah did not make it to $1 million. Like Real Life Sarah’s first contribution, her HSA account missed out on over half a million of growth, ending at only half of Perfect Sarah’s account balance of $1,120,198.

Lessons from Real Life Sarah

The tales of Perfect Sarah and Real Life Sarah really drive home just how powerful an HSA can be for building retirement wealth – if you stick to the script and let compounding work its magic over many decades.

Perfect Sarah played things perfectly, demonstrating the immense power of consistently maximizing HSA contributions and investing them for compound growth over the long term. Meanwhile, Real Life Sarah’s journey was a little more relatable and human. There were job changes, insurance gaps, yearly sunglasses splurges, and times when she couldn’t max out contributions. But even with all those road bumps, she still managed to accumulate an impressive over half a million dollars in her HSA by age 65.

The steps are simple:

- Start contributing to an HSA as early as possible and maximize contributions each year to take full advantage of tax-free growth.

- Invest HSA funds rather than letting them sit in cash to harness compound growth over decades.

Just think about it – a million bucks sitting there, ready to cover those inevitable medical costs in retirement without any taxes dragging it down.