As someone who spent years navigating the intricate world of finance, I’ve often been asked whether hiring a financial advisor is truly worth it. While I’m not a financial advisor myself, my career has been deeply rooted in the finance industry, particularly within the hedge fund realm. In particular, I specialized in the financial sector, which included banks, trading firms, and, yes, the wealth management subsector (don’t even get me started on the insurance subsector).

You might wonder, why does this set me apart? Well, unlike many others, I don’t have a vested interest in promoting financial advisory services. I don’t have skin in the game, nor do I have any former colleagues waiting in the wings to defend themselves. As someone who worked in finance, covering finance, I have the knowledge base on how the financial advisor industry works and how they market their services… without the biases of someone who worked as one.

So, should you hire a financial advisor?

There’s Different Types of Financial Advisors… Don’t Pick the Wrong One

First, let’s go over what a financial advisor is, and if there’s any differences between them. (Hint: there are). A financial advisor is someone who provides advice to individuals on managing their finances, investments, and financial planning. They can go by various monikers, like financial planner, wealth manager, or money coach.

But overall, there are 2 main types of advisors: registered investment advisors (“RIAs”) and brokers-dealers (“brokers”).

And when it comes down to it, RIAs are better because of 2 major differences:

1) They Charge Differently

RIAs earn fees based on how much money they manage for you, while brokers earn commissions from product sales. This means that the more investments you buy, the more brokers make.

Bottom line: When researching potential advisors, ask how they get paid.

2) Their Work Is Held To Different Standards

RIAs are required by law to put your best interests ahead of their own (called the “fiduciary standard”). On the other hand, brokers only need to make sure the investments they sell meet a “suitability standard”, which means they are not required to act in your best interest.

The SEC tried to improve the situation in 2020 by creating a new “best interest” standard for brokers… but the jury’s still out on whether this brings brokers inline with RIAs.

Bottom line: Don’t hire someone that isn’t required to look out for your best interests.

The “Relationship Manager”

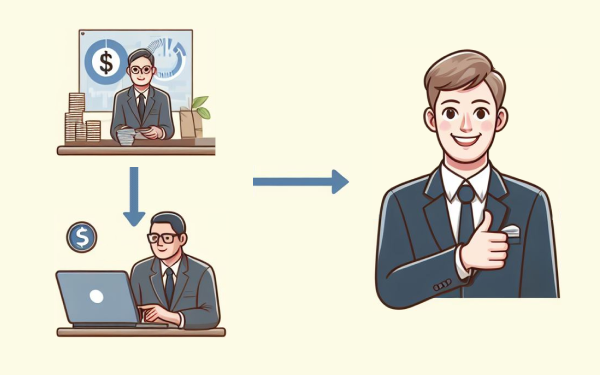

So how do these advisors actually manage your money? The reality is…they often don’t directly manage it at all.

Here’s what typically happens:

- You meet with a “relationship manager” who asks about your financial situation and goals

- Next, your money gets plugged into pre-built portfolios based on your risk tolerance

- That’s it!

The relationship manager’s main job is to explain the model portfolio approach to you, not manage your money. You see, managing money through basic asset allocation models is quite systematic – something a basic computer program could handle. What you’re really paying for is the human relationship, guidance, and oversight… even if an algorithm is doing most of the heavy lifting behind the scenes.

Do I Really Need to Pay for That?

From my perspective, most people can get by without hiring a dedicated financial advisor. There just isn’t a need for one. It’s more of a want, in most cases. There’s a good chance that most financial matters can be successfully navigated through self-education, technology tools, and automating savings/investments accordingly.

However, that’s not to say it isn’t justified, especially if you’re in one of the below situations:

- Bespoke or Complex Scenarios: If you have an intricate financial situation spanning multiple issues (business ownership, inheritance, divorce, etc.), an advisor can help you figure it out.

- One-Time Planning Needs: For major one-off events like drafting a will or setting up complex accounts, it may be worth paying an expert instead of becoming an expert yourself.

- You Literally Hate It: Some people loathe dealing with money management so much that they’re willing to outsource it entirely.

As an example of someone who could, but didn’t: One of my ex-bosses was a portfolio manager who managed billions for a living, and was certainly capable of managing his own money.

Except that he didn’t, and he paid someone else to do it.

Finally, How To Choose

If you do decide to work with an advisor, make sure they meet a few criteria.

Look for the words “Registered Investment Advisor” to find someone who has a fiduciary duty to put your interests first. Do your homework on potential conflicts of interest between you and your advisor, including reading reviews to find someone trustworthy. Pick someone you like, since that personal relationship is what you’re truly paying for.

And, once you’ve hired someone, don’t be afraid to call them as much as you want, so that they can explain everything to your heart’s content.